Collaborative Robot Brand Landscape: Strategic Analysis of Top 5 Contenders

The collaborative robot (cobot) market has exploded, driven by demand for flexible, safe automation accessible to SMEs and large enterprises alike. While numerous players compete, five brands consistently dominate market share and mindshare: Universal Robots (UR), Techman Robot, FANUC, ABB, and Doosan Robotics. Understanding their distinct strengths and weaknesses is crucial for selecting the optimal partner. Here's a strategic breakdown:

1. Universal Robots (UR): The Pioneer & Market Leader

- Strengths:

- Dominant Market Share & Ecosystem: UR virtually created the cobot market. Its massive installed base means unparalleled third-party support (grippers, vision, software), extensive online resources, and a vast knowledge pool.

- User-Friendliness: UR sets the standard for intuitive programming via the teach pendant (Polyscope). Setup and redeployment are remarkably fast, requiring minimal robotics expertise.

- Flexibility & Lightweight Design: Known for agility and ease of integration into existing workflows, even on mobile platforms.

- Strong Channel Network: A global network of system integrators and distributors provides local support and application expertise.

- Proven Reliability: Years of field deployment have established a strong track record for robustness in many applications.

- Weaknesses:

- Payload Limitations: Historically lagged in higher payload options (though the UR20 begins to address this).

- Integrated Vision: Lacks native, integrated vision like some competitors, relying more heavily on third-party solutions.

- Controller Size: The external controller can be bulkier than some integrated designs.

- Price Premium: Positioned at the higher end of the market, reflecting brand value and ecosystem.

- Software Depth (Advanced): While easy to start, very advanced motion planning or complex logic might require external PLC integration compared to some industrial rivals.

2. Techman Robot: The Integrated Vision Innovator

- Strengths:

- Native Integrated Vision: Techman's standout feature. Every cobot has built-in, high-quality vision (2D and increasingly 3D) within the controller, drastically simplifying vision applications (pick-and-place, inspection).

- All-in-One Controller: Combines robot control, vision processing, and often PLC-like functions in a single compact unit, simplifying wiring and footprint.

- Competitive Performance: Offers excellent path accuracy, repeatability, and speed at various payloads.

- Value Proposition: Often provides a compelling price-to-performance ratio, especially when factoring in the integrated vision savings.

- Growing Ecosystem: Actively expanding its partner network and application portfolio.

- Weaknesses:

- Younger Brand: Less established market presence and brand recognition than UR or FANUC in some regions.

- Ecosystem Maturity: While growing rapidly, the third-party accessory and integrator network isn't yet as vast as UR's.

- Software Refinement: TMflow is powerful but some users report a slightly steeper initial learning curve or less polished UI compared to UR's Polyscope for basic tasks.

- Documentation/Community: Resources and community forums, while improving, are not as extensive as the market leader's.

3. FANUC: The Industrial Automation Powerhouse

- Strengths:

- Unmatched Industrial Pedigree & Reliability: Leverages decades of experience in industrial robotics. CRX series cobots are built for demanding 24/7 environments with exceptional durability and precision.

- High Payload & Reach: Offers some of the strongest payload capacities (up to 35kg) and longest reaches among leading cobots.

- Seamless Factory Integration: Integrates flawlessly with other FANUC automation (CNCs, PLCs, SCADA) and common industrial protocols. Ideal for brownfield automation.

- Advanced Software (for Complex Tasks): Provides powerful, proven software (e.g., handling complex paths, force control) backed by deep industrial expertise.

- Global Support & Service: Extensive, mature global service and support infrastructure.

- Weaknesses:

- Complexity & Cost: The software (Teach Pendant) and setup can be significantly more complex and intimidating for first-time users or SMEs compared to UR or Techman. Higher initial investment.

- User-Friendliness: Programming philosophy leans towards traditional industrial robotics, requiring more specialized skills for advanced tasks.

- "Cobot Feel": Some models prioritize industrial robustness over the "lightweight collaborative" feel of UR or Doosan. Safety features are comprehensive but integration might require more careful planning.

- Ecosystem Focus: Third-party ecosystem, while strong, is often geared towards traditional industrial components rather than the broader cobot accessory market.

4. ABB: The Precision Engineering Leader

- Strengths:

- Engineering Excellence & Precision: Renowned for exceptional motion control, path accuracy, and smoothness, critical for high-precision tasks like assembly and electronics.

- YuMi Series Design: The dual-arm YuMi (pictured) is iconic for small-parts assembly, featuring highly sensitive safety and dexterous hands.

- Single-Arm Cobots (SWIFTI): Combine collaborative speed/safety with industrial robot performance (up to 4m/s in non-collab mode) and higher payloads.

- Wizard Easy Programming: Offers a simplified graphical programming interface alongside its powerful RobotStudio suite.

- Strong Industrial Integration: Like FANUC, excels in integrating into complex industrial ecosystems (PLC, MES).

- Weaknesses:

- Cost: Positioned at the premium end of the market.

- Complexity: Full utilization of capabilities often requires expertise in RobotStudio or similar industrial tools. Wizard Easy is simpler but may lack depth for complex apps.

- Market Focus: Historically stronger in large industrial automation; SME-focused marketing and channel sometimes perceived as less aggressive than UR or Doosan.

- Controller Footprint: External controllers can be substantial.

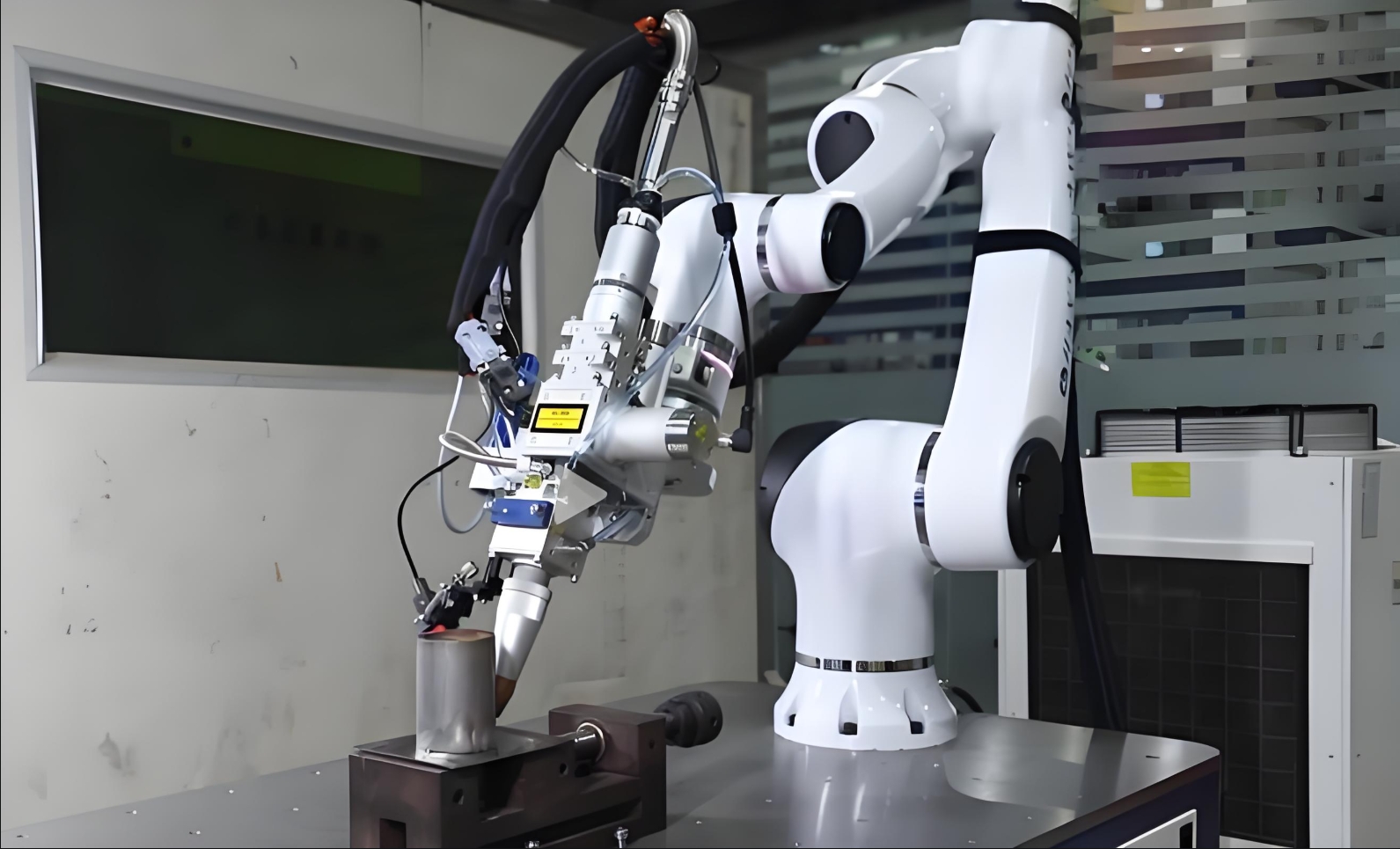

5. Doosan Robotics: The Agile Value Challenger

- Strengths:

- Aggressive Value & Performance: Disruptive pricing combined with very competitive specifications (speed, payload, reach). Offers high performance per dollar.

- Compact Integrated Controller (NINOX): Highly compact, lightweight controller simplifies integration and mobile applications.

- User-Friendly Software (DRL Studio): Modern, intuitive interface (flowchart and block-based) designed for ease of use, including simulation and vision tools.

- Rapid Innovation: Consistently launches new models and features, demonstrating strong R&D commitment.

- Wide Payload Range: Extensive portfolio covering 5kg to 25kg payloads effectively.

- Weaknesses:

- Newest Major Player: While growing explosively, has less long-term field history and a smaller global installed base than UR or FANUC. Brand recognition still developing in some regions.

- Ecosystem Development: Third-party accessory and integrator network is expanding rapidly but not yet as mature or ubiquitous as the market leaders'.

- Documentation & Support Depth: Resources and tiered support infrastructure are building but may not yet match the decades-old networks of UR or FANUC globally.

- Industrial Ruggedness Perception: While robust, may not yet carry the same perception of extreme industrial endurance as FANUC or ABB in the most demanding 24/7 heavy-duty scenarios (though capabilities are strong).

Strategic Synthesis & Choosing the Right Brand:

- For Maximum Ecosystem & Ease of Use (SME Focus): Universal Robots remains the safest, most supported bet, especially for companies new to automation or needing maximum flexibility and third-party options.

- For Vision-Centric Applications & Integrated Simplicity: Techman Robot offers a compelling, often cost-effective solution where built-in vision is a primary requirement, reducing complexity and footprint.

- For Heavy Payloads, Industrial Rigor & Integration: FANUC and ABB are the go-to choices for demanding factory environments, high-precision tasks, and seamless integration into large-scale industrial systems, accepting the higher complexity and cost.

- For High Performance/Value Ratio & Modern Software: Doosan Robotics presents a very attractive option for cost-conscious buyers seeking strong specifications, ease of use, and rapid innovation, while acknowledging its relative newness.

Conclusion:

The "best" cobot brand doesn't exist universally. The optimal choice hinges entirely on the specific application requirements, budget, in-house expertise, and integration environment. UR offers unparalleled ease and ecosystem maturity. Techman excels with integrated vision simplicity. FANUC and ABB deliver industrial power and precision. Doosan disrupts with compelling value and modern design. By carefully weighing the distinct strengths and weaknesses outlined above against their specific operational needs, manufacturers can strategically select the collaborative robot partner that best empowers their automation journey. The competition is fierce, driving continuous innovation, ultimately benefiting all users.

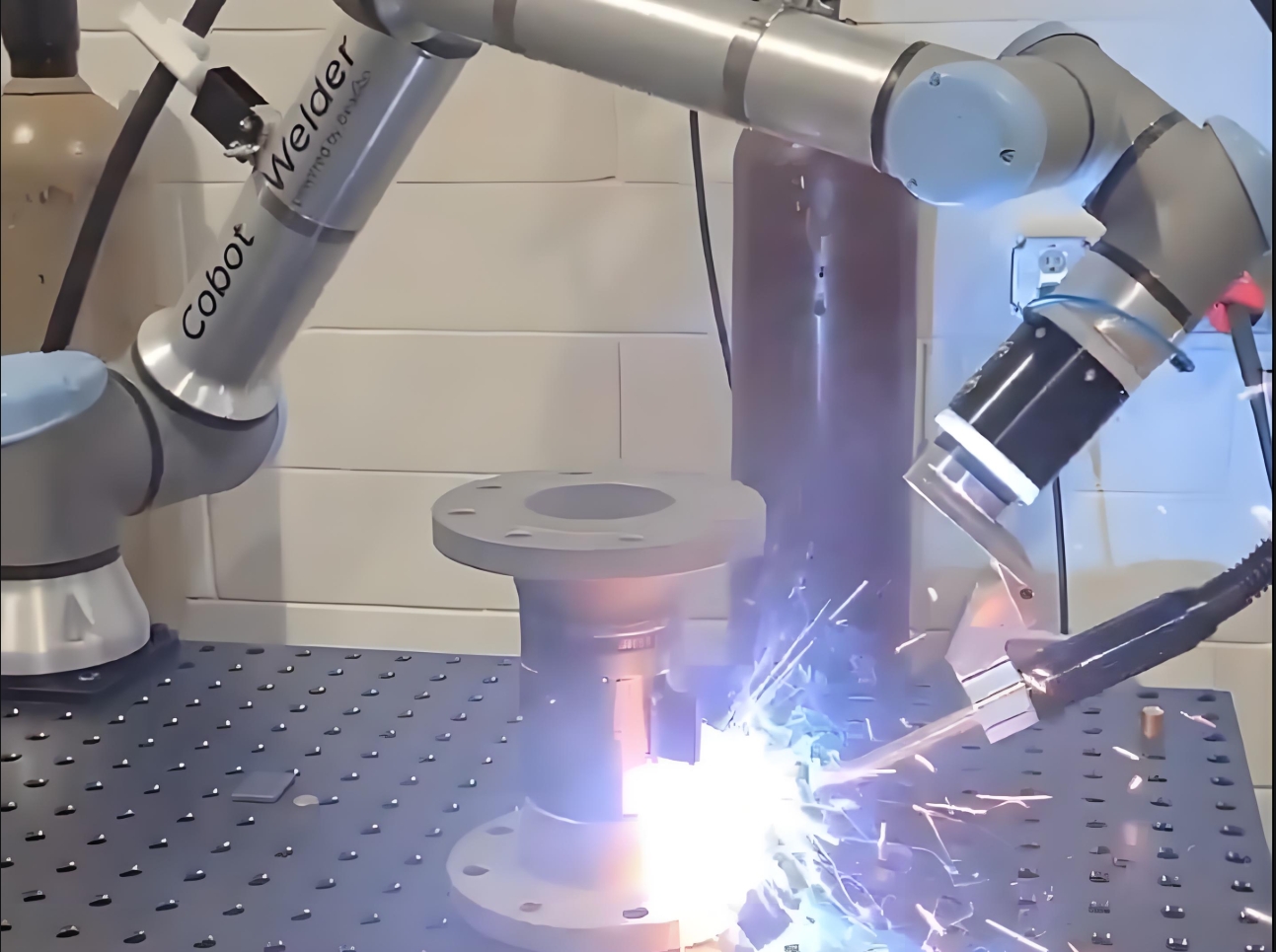

Cobotwelder,,Weldingcobot,,Cobot,,Collaborative

BLOG