Comprehensive Analysis of Universal Robots (UR): Strengths, Weaknesses and Market Position

The following is my personal thoughts. If there are any inaccuracies or offensive elements, please feel free to contact me for deletion.

Executive Summary

Universal Robots (UR), a pioneer and dominant force in the collaborative robot (cobot) market, has revolutionized automation accessibility. Acquired by Teradyne in 2015, UR boasts over 50,000 cobots deployed globally as of 2023, commanding an estimated 40-50% of the global cobot market share (Interact Analysis, 2023). This report provides a data-driven analysis of UR's key strengths and weaknesses, examining technical specifications, ecosystem, usability, financial considerations, and limitations compared to evolving competition and traditional industrial robots. Understanding this landscape is crucial for strategic decision-making within the collaborative robotics sector.

1. Introduction: Defining the UR Cobot Landscape

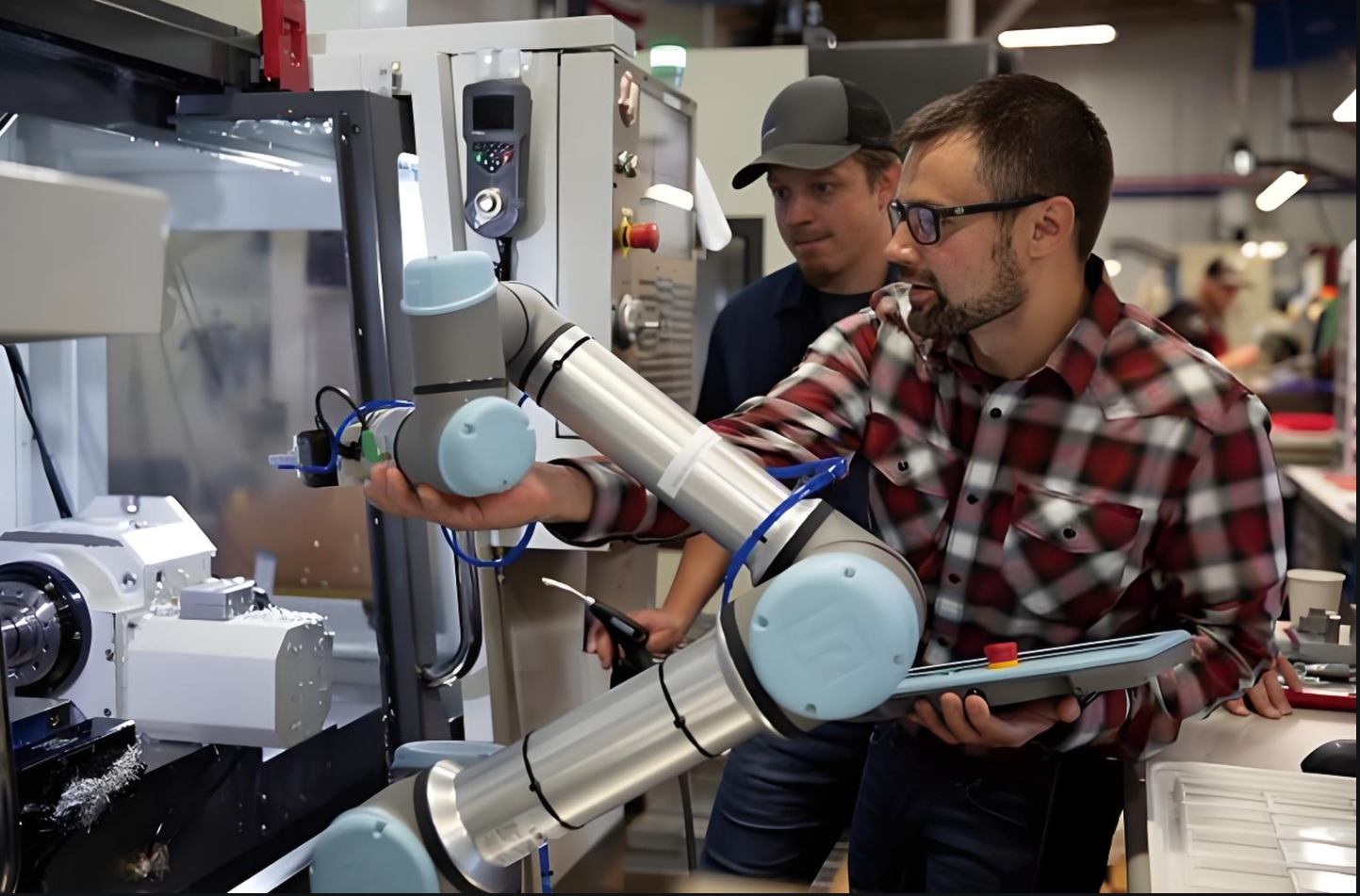

UR's core product line consists of the e-Series (UR3e, UR5e, UR10e, UR16e) and the newer, higher-payload UR20. These cobots are explicitly designed for safe collaboration with humans in shared workspaces without traditional safety cages (when risk-assessed appropriately), adhering to ISO/TS 15066 standards. Their target market spans SMEs lacking robotics expertise to large enterprises seeking flexible automation cells.

2. Core Strengths of Universal Robots

- 2.1 Unparalleled Ease of Use & Rapid Deployment:

- Intuitive Programming: UR's proprietary Polyscope interface, featuring graphical Blockly-based programming and intuitive teach pendant operation, drastically reduces setup time. Studies indicate programming times can be 70-80% faster than traditional industrial robots, often requiring minimal or no coding expertise (UR Case Studies). Typical deployment is cited within hours or days, not weeks or months.

- Simplified Integration: Lightweight design (e.g., UR10e: 33.5 lbs / 15.2 kg) facilitates easy mounting on tables, walls, or mobile platforms. Standardized electrical interfaces (tool I/O, EtherNet/IP, TCP/IP, PROFINET, Modbus TCP) simplify connections. UR claims over 80% of installations require no external system integrator.

- Teach Pendant Efficiency: The responsive 3D visualization and direct manipulation of waypoints significantly streamlines path creation and modification.

- 2.2 Safety & Collaborative Design (Core Value Proposition):

- Inherent Safety Features: Power and force limiting (PFL) technology, rounded surfaces, and inherent design minimize injury risk during contact. UR cobots are certified to PLd (ISO 13849) and SIL 3 (IEC 62061) safety levels.

- Cost Savings on Safeguarding: By enabling closer human-robot interaction, UR cobots often eliminate the need for expensive safety cages or light curtains. A 2021 study by the Association for Advancing Automation (A3) estimated safeguarding cost reductions of 40-60% for cobot deployments vs. traditional robots in suitable applications.

- Flexible Workspace Design: The compact footprint and collaborative nature allow integration into existing production lines without major layout overhauls.

- 2.3 Flexibility & Quick ROI:

- Rapid Task Switching: Program changes and tooling swaps (leveraging the UR+ ecosystem) enable repurposing a single cobot for multiple tasks within a shift or day. UR cites average payback periods of 6-12 months across diverse applications, significantly faster than traditional automation.

- High Mix, Low Volume (HMLV) Suitability: Ideal for environments requiring frequent product changeovers or small batch sizes where dedicated hard automation is uneconomical. A BMW Group case study reported a 50% reduction in cycle time and flexibility to handle 6 different models on one UR-powered station.

- Scalability: Adding additional UR cobots is relatively straightforward due to standardized programming and integration.

- 2.4 Expansive Ecosystem (UR+):

- Market-Leading Platform: The UR+ program is arguably the most mature cobot ecosystem, featuring over 400 certified partners offering more than 1,000 certified components (end-effectors, vision systems, software, accessories) as of Q3 2023.

- Pre-Validated Integration: UR+ components are tested and certified for plug-and-play compatibility, drastically reducing integration complexity, risk, and time-to-operation. This lowers the barrier to entry significantly.

- Application-Specific Solutions: The ecosystem provides readily available solutions for common tasks (machine tending, packaging, screwdriving, welding, quality inspection).

- 2.5 Strong Performance Metrics (for Class):

- Repeatability: UR e-Series cobots offer excellent repeatability for collaborative arms: ±0.03mm (±0.0012") for the UR3e/UR5e and ±0.05mm (±0.002") for the UR10e/UR16e. This meets or exceeds requirements for many assembly, dispensing, and inspection tasks.

- Reach: Models cover a wide range: UR3e (500mm), UR5e (850mm), UR10e (1300mm), UR16e (900mm), UR20 (1750mm). The UR20's reach is a significant step up.

- Footprint-to-Reach Ratio: UR cobots generally offer a very compact footprint relative to their workspace envelope.

3. Key Weaknesses and Limitations

- 3.1 Payload and Speed Limitations:

- Payload Constraints: Despite the UR20 (20kg), UR's payloads (3kg to 20kg) are significantly lower than traditional industrial robots (often 100kg+) and even some newer heavy-payload cobot competitors (e.g., FANUC CR-35iA: 35kg, Yaskawa HC30DTP: 30kg, KUKA LBR iisy: 20kg). The UR16e (16kg) was previously the max.

- Speed vs. Payload/Safety Trade-off: While improving, UR cobots inherently sacrifice speed for safety and force limiting. Operating speeds are generally 30-50% slower than similarly sized traditional industrial robots performing the same point-to-point moves under full automation (no collaboration required). High-speed, high-inertia applications remain challenging.

- UR20 Performance Nuance: While the UR20 offers higher payload and reach, achieving its maximum payload at full extension can impact speed and cycle time compared to lighter payloads or shorter reaches.

- 3.2 Precision and Stiffness Constraints:

- Absolute Accuracy vs. Repeatability: While repeatability is excellent, absolute accuracy is lower (typically ±0.1mm to ±0.5mm depending on model, payload, and reach) compared to high-end industrial SCARA or 6-axis robots. This necessitates compensation (e.g., using vision) for high-precision placement tasks requiring absolute positioning.

- Lower Stiffness: The lightweight design and joint construction result in lower structural stiffness than industrial counterparts. This can lead to noticeable deflection under load or during high-speed movements, impacting precision in force-sensitive tasks or when encountering unexpected resistance. Vibration damping can also be a factor.

- 3.3 Software and Advanced Capabilities:

- PolyScope Limitations: While excellent for basic to intermediate programming, PolyScope lacks the depth and advanced features (complex path planning, sophisticated logic, simulation integration) found in industrial robot controllers (e.g., FANUC's ROBOGUIDE, ABB's RobotStudio). Complex applications often require external PLCs or scripting.

- Advanced Feature Lag: Integration of cutting-edge features like AI-based adaptive control, advanced force control beyond simple insertion, or sophisticated predictive maintenance analytics is often slower to arrive or less mature on the UR platform compared to R&D efforts by larger industrial players or specialized AI startups.

- Real-Time Performance: The underlying control architecture may not match the determinism and hard real-time performance of high-end industrial controllers critical for ultra-high-speed synchronization.

- 3.4 Cost Considerations:

- Higher Initial Cost per kg Payload: While offering excellent ROI, the upfront cost per kilogram of payload capacity for a UR cobot is generally 2-5 times higher than a traditional industrial robot of similar reach but much higher payload capacity. The UR20's premium price point accentuates this.

- Tooling & Ecosystem Costs: While UR+ simplifies integration, certified end-effectors and peripherals can carry a significant premium over generic alternatives, impacting the total cost of the automated cell.

- 3.5 Application Suitability Gaps:

- Heavy Payload/High-Speed Tasks: Clearly unsuitable for palletizing heavy loads, large part handling, or very high-speed continuous operations where industrial robots dominate.

- Ultra-High Precision Tasks: Applications requiring micron-level absolute accuracy (e.g., semiconductor manufacturing, certain medical device assembly) are better served by specialized precision robots.

- Harsh Environments: Standard UR models are not IP69K rated and may not be suitable for extreme washdown, high-temperature, or highly explosive environments without significant additional protection, where specialized industrial robots exist.

4. Market Position and Competitive Landscape

UR remains the undisputed market leader in unit sales and installed base. However, competition is intensifying:

- Traditional Industrial Giants: ABB (YuMi, SWIFTI), FANUC (CRX series), Yaskawa (HC series), KUKA (LBR iisy) leverage their scale, precision heritage, and deep industrial integration expertise. They are rapidly closing the usability gap while often offering higher payloads or speed within their cobot lines.

- Dedicated Cobot Players: Techman Robot (strong integrated vision), Doosan Robotics (aggressive pricing, high payloads), AUBO (cost-effective) offer compelling alternatives, often matching or exceeding UR specs in specific areas (e.g., Techman's built-in vision, Doosan's price/performance).

- Low-Cost Providers: Chinese manufacturers are entering the market with aggressively priced cobots, putting pressure on the mid-range, though often with compromises in ecosystem, software, or long-term support.

UR's key advantage remains its massive ecosystem (UR+) and brand recognition as the "default" cobot. However, maintaining leadership requires continuous innovation, particularly in software, high-payload performance, and addressing precision/stiffness limitations.

5. Conclusion and Strategic Implications

Universal Robots democratized industrial automation, establishing the cobot category with compelling strengths: unparalleled ease of use, rapid deployment, inherent safety enabling human collaboration, exceptional flexibility for SMEs and HMLV production, a vast certified ecosystem, and strong repeatability within their class. Their dominance is evidenced by a ~50% market share and widespread adoption.

However, UR faces significant challenges. Payload and speed limitations restrict their scope compared to industrial robots and newer heavy-payload cobots. Lower stiffness and absolute accuracy necessitate workarounds for demanding precision tasks. While user-friendly, PolyScope lacks advanced capabilities for complex applications. Cost per kg payload remains high, and specific application gaps exist.

Strategic Implications for the Collaborative Robotics Industry:

- UR's Niche: UR excels in applications requiring flexibility, ease of use, safe collaboration, and rapid ROI in the light-to-medium payload range (1-16kg standard, 20kg with UR20). They are ideal for SMEs, high-mix environments, and tasks like machine tending, assembly, packaging, dispensing, and inspection where their speed is sufficient.

- Competition Response: Competitors are effectively targeting UR's weaknesses: offering higher payloads (FANUC, Yaskawa, Doosan), better integrated vision/AI (Techman), superior precision/stiffness (traditional players), or lower cost (AUBO, Chinese entrants). UR must innovate aggressively beyond reach/payload (UR20) into software, AI, and advanced control to maintain its edge.

- Market Evolution: The lines between cobots and traditional robots are blurring. UR's success forced industrial giants to adapt, leading to more user-friendly interfaces on industrial arms and higher-performance cobots. The future belongs to platforms that seamlessly blend collaborative safety, ease of use, industrial strength, and intelligent capabilities. UR's vast ecosystem is a major asset, but its technological core must continue evolving to meet rising performance expectations.

UR pioneered a transformative path, but its continued leadership hinges on addressing its technical limitations while leveraging its ecosystem and brand strength in an increasingly competitive and sophisticated market. The data underscores both their remarkable achievements and the tangible constraints they must overcome.

Cobot,,weldingcobot,,cobotwelder,,UR

BLOG